- Turbo tax business and home full#

- Turbo tax business and home software#

- Turbo tax business and home free#

The tax software will calculate the depreciation on these assets going forward. If you own an S Corp, partnership, C Corp, or multiple-owner LLC, choose TurboTax Business. If you're preparing your own tax return for the first time, you'll need to enter the details of the assets the business has that it is depreciating as of the beginning of this tax year into TurboTax.

Turbo tax business and home full#

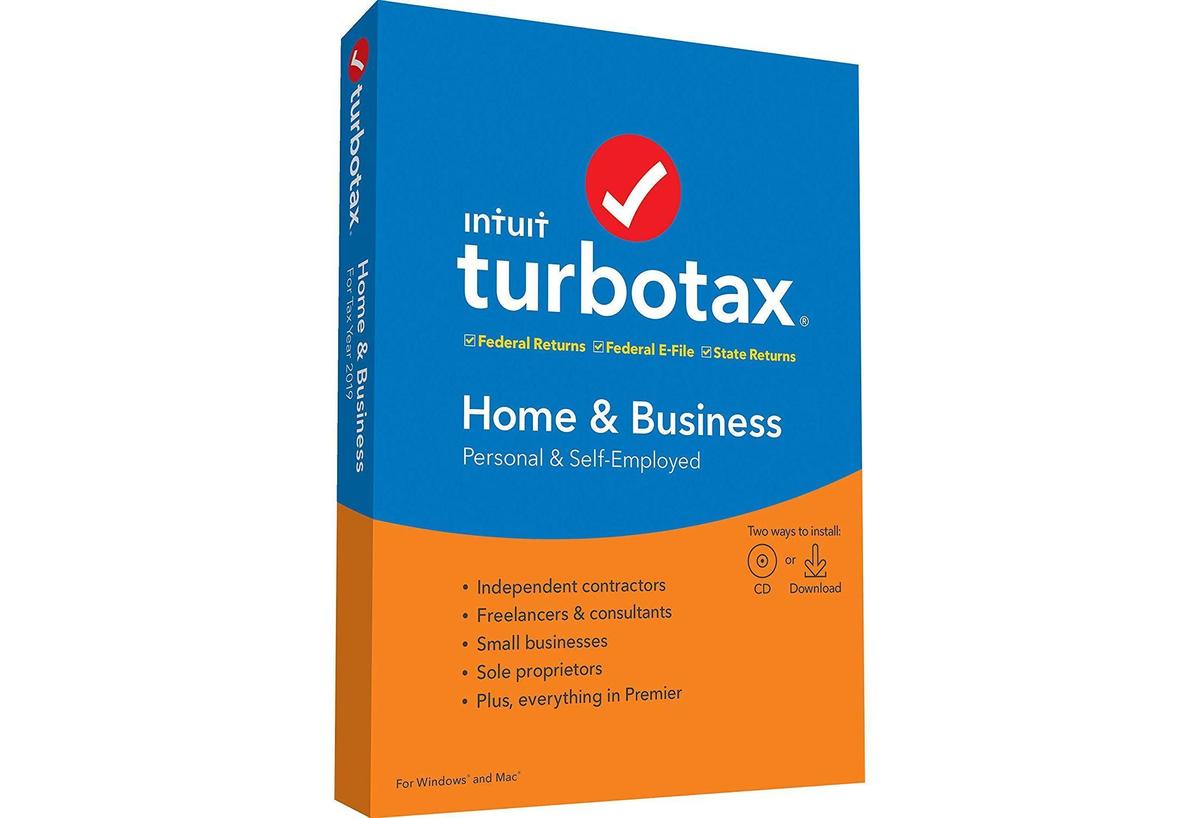

Why TurboTax Home & Business is the easiest choice for you TurboTax Home & Business was designed to help you take full advantage of your personal and business deductions so you get the biggest tax refund possible.Ĭhoose TurboTax Home & Business if any of the following apply to you: Additional State filings are available for an additional charge. We search for more than 350 personal and self-employment deductions to get you the biggest tax refund possible-guaranteed.Įfile with direct deposit to get your refund in as few as 8 days. Maximizes personal and business deductions We customize questions to your unique situation, import your info from last year, and put it all on the right tax forms for you. The IRS will confirm receipt by e-mail within 48 hours. The moment the IRS starts accepting returns, scheduled for January 15, 2010, TurboTax will submit your efiled return. Here's how efile works: Start your return and efile with TurboTax today. Get Your Refund Fast: Efile Your 2009 Taxes with TurboTax Product Description Product Description If you're a sole proprietor, consultant, contractor or single-owner LLC, TurboTax Home & Business will get you the biggest tax savings.

Turbo tax business and home free#

Free Federal E-File-receive IRS confirmation and get your refund in as few as 8 days.Creates W-MISC forms for your employees and contractors America First Credit Union offers savings & checking accounts, mortgages, auto loans, online banking, Visa products, financial tools, business services.Expanded interview guides you step-by-step through entering business income and expenses to help you maximize business and personal deductions.Includes everything you need for your self-employment and personal income taxes.TurboTax Home & Business helps you get the biggest refund for you and your business.

Once you have signed into your account, you can also select Contact at the top of the page to get connected with an expert. If you have questions about using TurboTax or need assistance, visit their FAQ page. You can read more about the tiered pricing options on the TurboTax website. Visit the TurboTax website to get started. The bottom line here is that TurboTax is an excellent program to help you quickly and easily do your taxes - even if you file a Schedule C as a small business owner. When signing up for TurboTax, you’ll be prompted to connect your Square account to your TurboTax filing and from there, you’ll see your transaction data upload automatically. If you are using Square for payments processing, you are able to sync your sales data from Square to TurboTax without the need to enter transaction data manually.

No paper forms are required, and TurboTax will fill out your electronic tax filings with your information so you don’t have to. Submitting returns for small business income tax, company expenses, as well as tax deductions and credits is simplified with TurboTax’s step-by-step guidance throughout the filing process. TurboTax is an online tax software that guides individuals and business owners through tax preparation and filing. Integrate with Square Billing and Pricing TurboTax Support

0 kommentar(er)

0 kommentar(er)